Most of us don’t like to contemplate the need to prepare for our funeral and burial, but covering these services is an important part of estate planning and easing the financial worries of your loved ones. Not just that, but there are often other expenses remaining or you want to leave a donation to a cause close to your heart. That is why LRFA created a plan for these final expenses, with tax free benefits. Choosing your coverage requires a careful consideration of all your final needs.

Members can enroll in one or more of our plan options, from $1,000 to our highest combinations totaling $27,000.00 in benefits. These plans are available to all LRFA members between the ages of 18 and 78, as well as to their children from age 1 to 18. Join LRFA today!

Eligibility & Enrollment

Any LRFA member who wishes to be accepted into one or more of the LRFA Final Expense Plans must be between the ages of 1 and 78, and in good health. Download the form: Final Expense Plan Application ![]() .

.

Anyone who is not currently an LRFA member must first apply for membership: APPLY NOW

Advantages

- Available benefits up to $27,000.00

- Accidental death benefits up to $54,000.00

- LOW monthly payments

- Medical exam NOT required

- Disability is not an automatic disqualifier

- Premium group does NOT change with increase in age

Benefit Payments

Payments are issued after death to the beneficiaries designated by the member. Beneficiaries can be individuals and/or organizations. The benefit amount is dependent upon specific plan participation and the number of years of participation. In cases of accidental death, benefit payment is doubled. A minimum of one consecutive year of participation is required for any benefits to be issued. Members who receive US government SSI can enroll in this plan as it is not a “burial fund” but a benefit paid to the member’s designated beneficiary for any purpose. It is not a “whole life” policy and does not accrue value.

Benefit Ineligibility

Benefits will not be paid out under the following conditions:

- If benefits are requested more than one (1) year after the death of the participating member

- In cases of suicide

- If monthly payments are delinquent

- If the member has cancelled particpation in a plan, or if participation has been terminated due to noncompliance with payment requirements

- If the member has not paid the LRFA annual membership dues and therefore has lost eligibility to benefits

Final Expense Plan Types

| Benefit Plans | After two (2) years | After three (3) years | After five (5) years | |||

|---|---|---|---|---|---|---|

| Natural cause | Accidental death | Natural cause | Accidental death | Natural cause | Accidental death | |

| E | $500.- | $1,000.- | $700.- | $1,400.- | $1,000.- | $2,000.- |

| F | $600.- | $1,200.- | $800.- | $1,600.- | $1,500.- | $3,000.- |

| G | $1,000.- | $2,000.- | $1,500.- | $3,000.- | $2,500.- | $5,000.- |

| H | $1,500.- | $3,000.- | $2,000.- | $4,000.- | $5,000.- | $10,000.- |

| I | $2,000.- | $4,000.- | $2,500.- | $5,000.- | $7,000.- | $14,000.- |

| J | $2,500.- | $5,000.- | $3,000.- | $6,000.- | $10,000.- | $20,000.- |

| Premium group is assigned at the time of enrollment and is dependent on the member’s age at enrollment time. Premium group assignment is for the lifetime of the member. | ||||||

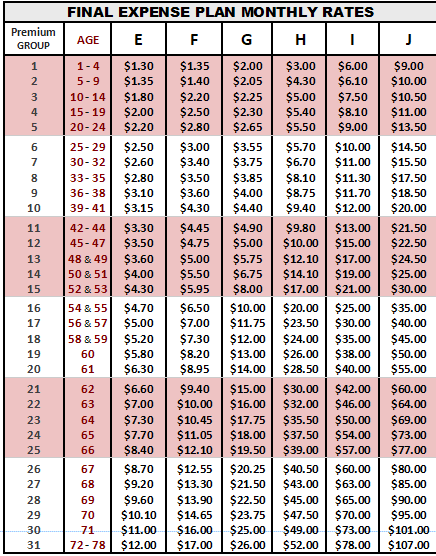

Monthly Fees for 2022-2024