Medicare is an essential means of protection for millions of Americans 65 and older. But Medicare doesn’t cover everything. A “Medigap” plan is health insurance sold by private insurance companies to fill gaps in Medicare coverage (coinsurance, copayments, or deductibles). Similarly, the LRFA Medicare Supplemental plans help our members cover those expenses.

There are different LRFA Medicare Supplemental plans, designed to meet your needs, including a separate Prescription Drug coverage plan (M-3). Join LRFA and let us help you.

Great customer service!

“I always found the people I spoke with when calling exceedingly helpful and pleasant.“

“I have been very happy with LRFA for many years.“

Why choose an LRFA Medicare Supplemental Plan?

- Simple application process, with no physical exam required

- Enroll at any time, no need to wait for an “enrollment period”

- Premiums do not vary by state of residence

- Coverage when traveling, without pre-authorization

- Change or increase plans at any time, without a penalty

- Full choice of doctors, hospitals, and pharmacies. No networks.

- All prescription drugs (from high cost, rare, to the least expensive generic drugs) are covered in M3

- Excellent customer service! – 97% of members surveyed rated our customer service as good or excellent!

Eligibility & Enrollment

Download a Medicare Supplemental Plan enrollment form

Current LRFA members must sign and complete the enrollment form and submit it by mail, along with all applicable fees. Anyone not currently an LRFA member may apply for membership at the same time as enrollment application.

Participation is open to all LRFA members, age 65 and older, who have Medicare coverage (Part A & B). You must provide a copy of your valid Medicare card. Individuals on Medicaid, Disability, or other government medical assistance programs are not eligible. Individuals with Medicare Advantage plans are not eligible.

What Is Covered?

The LRFA Medicare Supplemental Plans are similar to Medigap plans and designed with simplicity and cost-effectiveness. They help cover physician and hospital services, out-patient care, skilled nursing facility services, diagnostic tests, radiology and laboratory charges. We process your Medicare statements and follow Medicare guidelines for approved services, using the calculated amounts the patient is expected to pay. Invoices you receive from the provider should be submitted for all claims.

M-Basic covers:

- Medicare Part A hospital co-insurance

- Medicare Part B medical co-insurance

- Medicare Part A and B blood coverage

- After a $7,000 benefit allowance is reached, expenses are covered at a 50% rate.

M-1 covers:

- Medicare Part A hospital deductible AND co-insurance

- Medicare Part B medical deductible AND co-insurance

- Medicare Part A and B blood coverage

- Skilled nursing facility coinsurance

- After a $7,000 benefit allowance is reached, expenses are covered at a 50% rate.

M-2 covers excess charges:

- 100% of the difference between Medicare’s approved amount for Part B services and the actual billed provider charges

- maximum benefit for a single service rendered by a provider is $500

- maximum benefit allowed in a calendar year is $3000

M-3 is a Prescription drug coverage for LRFA members ages 65 and over. This plan covers 50% of all prescription drugs with no coverage gaps after a deductible has been met. Drugs must be prescribed by a licensed physician but do not have to be Medicare approved. Participation in Medicare is not required.

M-4 covers:

- Everything included in M-Basic, M-1, M-2, and M-3

- PLUS: Preventive care, including check-ups, cholesterol screenings, diabetes screenings, hearing tests and thyroid testing not covered by Medicare

- Short-term care, including at-home medical assistance while recovering from an illness, injury or surgery, if already receiving Medicare covered home health care services

M-6 covers:

- same as M-1, at a 50% rate

- The maximum benefit allowed is $10,000 per calendar year

M-7 covers:

- covers the same as M-4, after a deductible has been met

Waiting Periods

Waiting periods for benefit claims are 3 months (from the date of acceptance into a plan), for all new participants.

Not Covered

The LRFA Medicare Supplemental Plans DO NOT cover:

- Routine vision and dental care

- Over-the-counter purchased drugs or supplies, including hearing aids

- Services or supplies not approved or not within Medicare guidelines

- Expenses covered under another insurance plan or government medical assistance program, that is primary to Medicare

- Expenses not in accordance with Medicare and LRFA regulations or existing laws.

- Limitations may apply for expenses in excess of usual and customary charges.

Plan Fees for 2026

| M-Basic | COVERS:

|

Age 65-70: $149 Age 71-80: $190 Age 81+: $198 per month |

| M-1 | COVERS:

|

Age 65-70: $225 Age 71-80: $303 Age 81+: $315 per month |

| M-2 | COVERS:

|

Age 65-70: $70 Age 71-80: $95 Age 81+: $105 per month |

| M-3 | COVERS:

|

Age 65-70: $110 Age 71-80: $149 Age 81+: $187 per month |

| M-4 | Provides same coverage as plans M-1, M-2 and M-3 combined, plus:

|

Age 65-70: $404 Age 71-80: $539 Age 81+: $554 per month |

| M-6 | COVERS all procedures covered in M-1, at a 50% rate

|

Age 65-70: $105 Age 71-80: $124 Age 81+: $156 per month |

| M-7 | COVERS all procedures covered in M-4, after a deductible of $2,400 is met

|

Age 65-70: $225 Age 71-80: $252 Age 81+: $269 per month |

Compare Our Plan

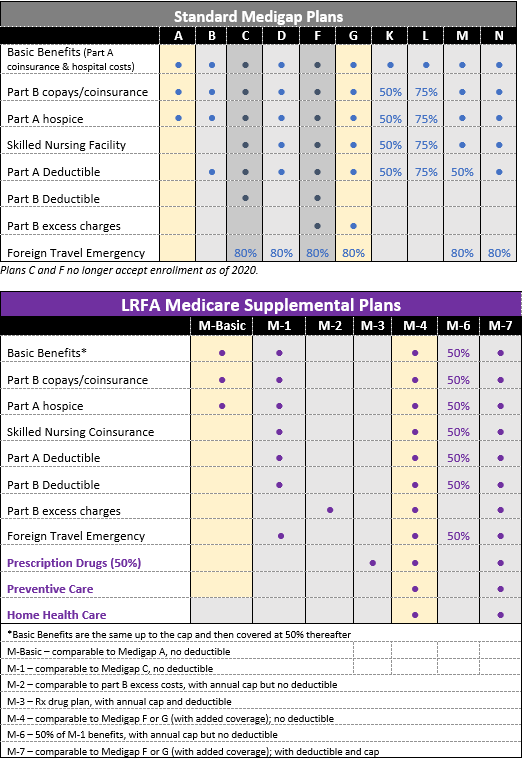

Medicare Supplemental Plans - Medigap and LRFA

Quick comparison charts Here is a quick look at how these plans compare in terms of coverage. Please read your plan regulations to determine how individual charges are calculated and any limits that may apply.

*Medigap plans C & F will no longer accept new enrollment as of Jan 1, 2020. If you live in Massachusetts, Minnesota, or Wisconsin, your state offers different standardized plans.

Compare LRFA Medicare Supplemental Plan annual costs with Medigap providers:

Although not an insurance company, LRFA offers similar benefits to its members with Medicare coverage. LRFA rates are the same for all 50 states. For other companies, your plan rates vary by state and other factors.

Medicare alone does not offer complete health insurance protection. For this reason most people seek additional health care coverage, which pays some of the amounts that Medicare does not pay for covered services and may pay for certain services not covered by Medicare. This type of private insurance is known as Medigap and is regulated by federal and state law, which mandates that all plans follow the same 10 standardized plans. This makes it easier for consumers to comparison shop.

LRFA makes every effort to set its member rates lower than those of major Medigap providers. Monthly payments are uniform, regardless of a participant’s state of residence or gender. Choice of health care providers is left entirely up to our member. When shopping for a Medigap plan, service and reliability are also important factors to consider. LRFA takes pride in giving our members the best service possible. Our Medicare Supplemental department has been working to serve our members’ since 1966.